Money Supply: A Primer

You walk into a Merchant and a sign says, "All Items on Sale Today for Cash Only No Credit."

You are interested in purchasing an item. The Merchant, being a crafty sort asks "How much money do you have to spend(in US dollars)?"

How would you answer that if you are being truthful?

You might start by looking into your wallet and pockets, and counting all the cash and coins you have with you at that moment.

This is equivalent to the monetary base, or M0. It is money you have that is immediately available requiring no change or conversion. There is very little risk to the merchant, unless it happens to be counterfeit which is easily verified.

"Not enough" says the Merchant. "I am sorry, but do you have more?"

M1

Then you remember that in addition to cash, you have your checkbook with a current balance in it, and a debit card to an account you maintain in a local bank, but with no overdraft or lines of credit provisions.

That plus the currency in your pockets is M1. See the difference? You do not have ALL your money in your pockets for immediate presentation, but with a little transactional effort the money is readily available and it is inherently your money, it belongs to you. It is just being held elsewhere besides your pockets and wallet. The merchant assumes a little more risk, but he can quickly call your bank to verify that the funds are available for the check, and the debit card is even more mechanized. More risk, a little more delay, but almost as 'good as cash.'

"I am sorry sir," says the Merchant, "but this is still not enough to exchange for such a valuable object as I have for sale here."

M2

You think about it, and remember that you have a savings account across the street at the bank, and a money market fund at your brokerage office next door, that have more of your money on deposit. You have no cards for those accounts, but it would be an easy thing to walk next door or across the street and obtain the cash.

This is M2. There is a more complex transaction involved, since the transfer is not electronic as in the case of a debit card, and you must leave the store to obtain the money in the form of currency unless they bring it over to you. But it is your money that is available to you on demand. There is a small amount of risk of your bank not being solvent when you need the money, but these are slight inconveniences compared to the safety of not carrying around large sums of money that earn no interest in the form of cash.

"I am so sorry," says the Merchant. "But this item is far too valuable to part with for such a sum as you have offered."

M3

You think about it, and remember that you have a large Certificate of Deposit at the bank across the street that matures in one year. There is a small penalty if you redeem it today to receive your money since you promised it to them for a time in exchange for a specific return, and you must fill out some paperwork, but it is still your money. It involves no sale of an asset or conversion.

That is M3. It involves money that is still yours without borrowing, but has additional conditions set up on it for its retrieval.

MZM

If one takes all the things we describe as M2, but takes out the time deposits or certificates of deposit, and includes ALL money market funds, that is what the Fed considers to be the broadest measure of liquid money, or Money of Zero Maturity (MZM). "Zero maturity" means that the money is not tied up for a period of time to mature to its full value.

Are credit cards or loans Money? No,those are all forms of borrowing something that is not yours that you promise to return with conditions. You are receiving money that was not yours.

Credit Is Not Money.

Credit, or debt, is the 'potential' for money, a way of receiving it.

Whether water is held in a canteen, a well, a cistern, or a private lake, it is still water and it is yours if you own it. So too money is still money if it is yours, no matter under what conditions you hold it or save it for your use.

The cloud of credit, or debt depending on your perspective, is the potential for money as it is defined in our economy. It is a source of money. At a given point in time, you either have the money as your property or you do not. But the source is not the money itself, and the source can be different and can change over time. In our society borrowing is so common and so technologically convenient that there is little difference in most people's mind between credit and money.

But the source is not the money itself, and the source can be different and can change over time. In our society borrowing is so common and so technologically convenient that there is little difference in most people's mind between credit and money.

But the difference is that if you spend real money, you incur no obligation for it in the future. You receive no payment request from another at the end of the month.

That is what money is, at least in our economy, and the various measure of money as it is held and shifts through the economy and a variety of transactions, where it flows and rest in pools, and moves again. A measure of the money supply is a snapshot in time.

How money increases or decreases, and how it is stored or held, is a significant indicator of economic activity for those who study such things. It is also significantly affected by custom, technology, and the prevailing mood and perception of the public.

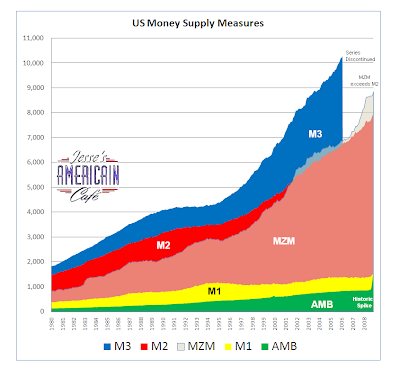

The best and broadest measures of money supply are either MZM, or M2, now that M3 is no longer being reported by the Fed. This can easily be seen from the illustrations.

As springs feed into brooks, and brooks streams, and streams into rivers, and rivers into lakes, so the money supply components change in size and shape over time as money flows from its various sources. The speed of the flow is the 'velocity of money' and as one can easily understand that flow will have a different force and speed depending on when you measure it, and whether you are measuring one of the streams or a major river.

Money is the instrument of the official economy. This gives money a certain arbitrariness over time because, after all, it is the product of a committee. Official money is the creation of government, managed by its agents, validated by the people who use it.

Official money rises and falls from favor to disfavor, as do governments. What if you were a citizen of Zimbabwe? Or the US in the 1860's? Or Germany in 1922? How would you feel about your official money then? Why is it different for you now? What would change your opinion?

What is the 'natural growth rate' of the money supply? Zero?

The discussion of how money supply increases, and who or what determines the supply, and what an appropriate level of growth would be is a matter for discussion on another day. So too is the strange phenomenon of 'natural forms of money' that keep turning up in every era and nearly every society.

But for now at least you have the means to understand what money supply is and how it is measured, and how it is different from potential money, or credit, the representations of money, and asset stores of wealth.

No comments:

Post a Comment